when will capital gains tax rate increase

She has no other capital gains or losses. Since 2003 qualified dividends have also been taxed at the lower rates.

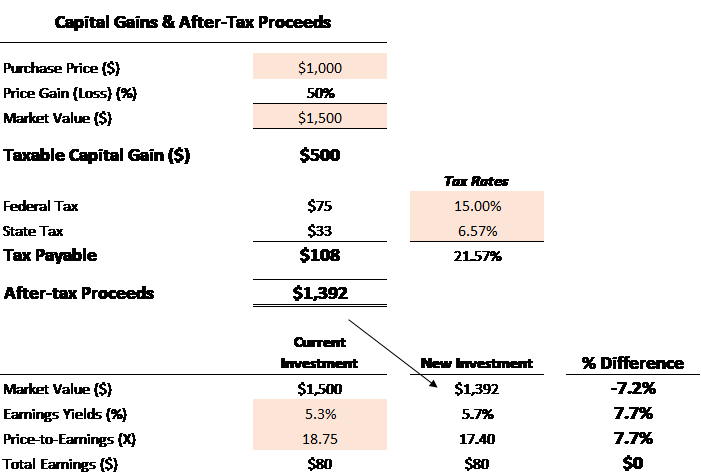

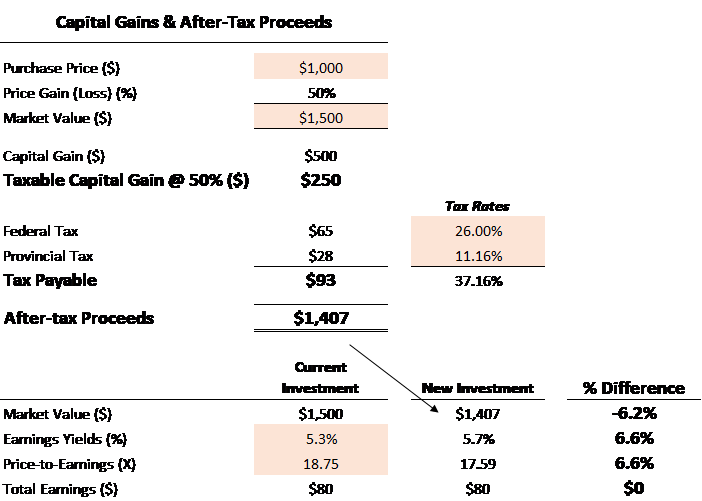

Capital Gains Tax Calculator For Relative Value Investing

Maree declares a capital gain of 500 in her tax return.

. She will pay tax on this gain at her individual income tax rate. For most of the history of the income tax long-term capital gains have been taxed at lower rates than ordinary income figure 1. She owns the shares for 6 months and sells them for 5500.

The maximum long-term capital gains and ordinary income tax rates were equal in 1988 through 1990. MAXIMUM TAX RATE ON CAPITAL GAINS.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Short Term Capital Gain Tax Capital Gain Capital Gains Tax Short Term Capital Gains Tax

Best Personal Finance Services In 2021 Accounting Services The Borrowers Capital Gains Tax

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)